Deductions

Overview

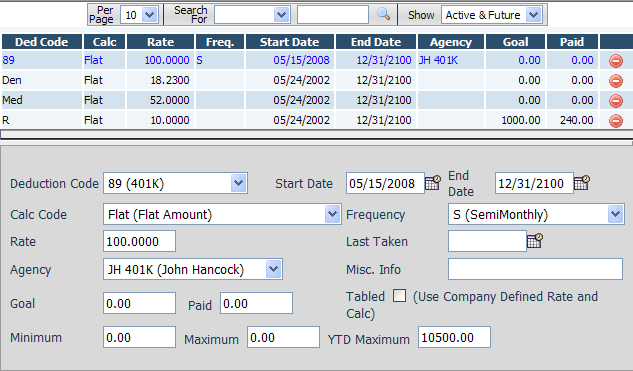

Amounts to be deducted from an employee’s paychecks on a recurring basis are entered here. One-time deductions should be entered directly onto an employee’s check when payroll is run.

Fields

• Deduction Code – The deduction code for this deduction.

• Start Date –The date on which the deduction will begin. If left blank, it will automatically populate with today’s date when saved.

• End Date – The date on which the deduction will end. If left blank, the end date will automatically populate with 12/31/2100 (forever).

• Calc Code – The calculation code for this deduction (e.g. Child Support, 401(k), Levy). For a flat amount, leave blank. If you need specialized calculations set up that are not in your list, please contact your customer care representative as we can accommodate a wide range of requests in this area.

• Frequency – The frequency for this deduction. If left blank, the deduction will be calculated on every payroll.

• Rate – The rate of the deduction. This rate gets sent to the calculation code script for this deduction. If there is no calculation code, this is treated as a flat amount.

• Last Taken – For frequency-based deductions, this displays the date of the last deduction. This date is used by the system to determine the date of the next deduction.

• Agency – The agency/third-party payee for this deduction.

• Misc Info – Any necessary additional information for the deduction (e.g. 401(k) loan numbers, child support case numbers).

• Goal – The goal amount to reach for the deduction. Set to zero if this deduction has no goal amount. Note that when using goal amounts, it is important to not have two active deductions with the same code as the system will apply deducted amounts for both to the paid amounts for both.

• Paid – The amount already paid towards the deduction goal. Every time the deduction is taken from the employee’s paycheck, the paid amount is incremented by the amount deducted. Once the paid amount has reached the goal amount, the deduction will stop being taken.

• Tabled – Indicates to use the company setup defined deduction calculation method instead of the settings on the Deductions tab. If checked, the rate, calc code, frequency, agency, minimum, maximum and YTD maximum on this page do not matter, as the deduction will use the company-defined settings instead.

• Minimum – The minimum amount for the deduction for each paycheck.

• Maximum – The maximum amount for the deduction for each paycheck.

• YTD Maximum – The calendar year maximum for the deduction.